To achieve financial stability, you must have a lot of equity in your house. This could come in the form of a large down payment or additional principal on your monthly repayments. You don't need to worry about the value of your home falling. You'll be able to pay for any expenses that may occur if something happens.

Investing in yourself

If you have difficulty meeting your financial goals, investing in yourself will help you get there. You can invest your career, in your physical and mental health, in your hobbies and interests, and even in your relationships. It is possible to invest in yourself and your health by getting regular exercise.

Save money

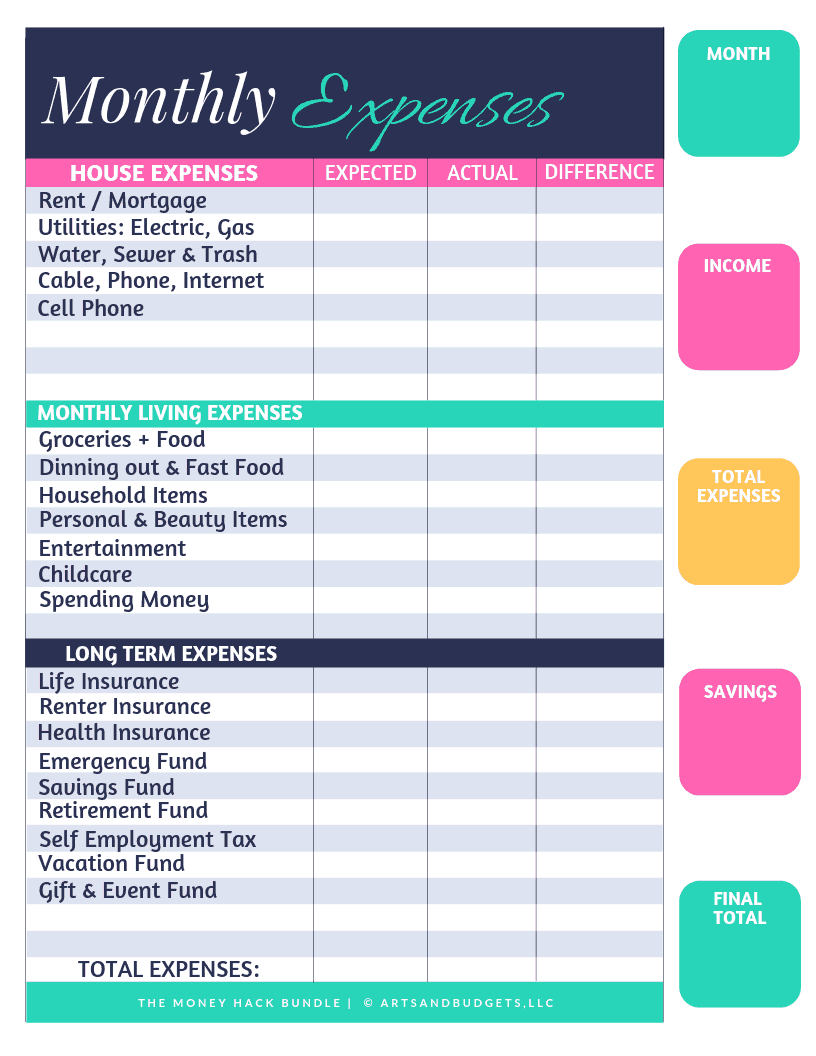

You must learn how to control your spending in order to create financial stability. Although this can seem daunting at first, it is possible with patience and education. Budgeting and understanding your debts are good places to start. It's also useful to keep track of your salary and expenses. Once you have a clear picture of how much you spend on each item, you can create a list detailing what you can afford each month.

Having an emergency fund

An emergency fund can be a great way for you to safeguard yourself against financial disasters. It is crucial to create it as soon as possible. It is like a life-raft that can be used whenever you need it. It can also be used to help you sleep better at night and reduce stress levels.

Living on less than your income

Financial stability means living below one's means, spending less than you make, and saving for the future. This also means not worrying about debt accumulation and stressing out over money.

A plan for financial problems

Financial stability is not just having a plan for your finances but also a plan that will help you deal with any challenges. A majority of Americans experience financial stress. In fact, nearly two thirds of Americans report feeling financially stressed at some point in their lives. 22 percent of those surveyed feel extremely stressed about financial matters. This is especially true of parents making less than $50,000 a yearly and younger adults. Unfortunately, high levels of financial stress often lead to unhealthy behaviors.

Having a large amount of equity in your home

A large equity stake in your home can be a key factor in financial stability. You can use the equity to make home improvements or consolidate debt. Equity can also be used to obtain a line or credit. The more equity you have in your home, the higher the loan amount you can get from a bank.

FAQ

What is a Financial Planner? How can they help with wealth management?

A financial planner can help you make a financial plan. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners can help you make a sound financial plan. They can help you determine how much to save each month and which investments will yield the best returns.

Financial planners usually get paid based on how much advice they provide. However, some planners offer free services to clients who meet certain criteria.

Who can help me with my retirement planning?

Many people consider retirement planning to be a difficult financial decision. It's more than just saving for yourself. You also have to make sure that you have enough money in your retirement fund to support your family.

The key thing to remember when deciding how much to save is that there are different ways of calculating this amount depending on what stage of your life you're at.

If you are married, you will need to account for any joint savings and also provide for your personal spending needs. You may also want to figure out how much you can spend on yourself each month if you are single.

If you're currently working and want to start saving now, you could do this by setting up a regular monthly contribution into a pension scheme. Another option is to invest in shares and other investments which can provide long-term gains.

Talk to a financial advisor, wealth manager or wealth manager to learn more about these options.

What is estate plan?

Estate Planning is the process that prepares for your death by creating an estate planning which includes documents such trusts, powers, wills, health care directives and more. These documents are necessary to protect your assets and ensure you can continue to manage them after you die.

Who should use a Wealth Manager

Everybody who desires to build wealth must be aware of the risks.

Investors who are not familiar with risk may not be able to understand it. Poor investment decisions could result in them losing their money.

Even those who have already been wealthy, the same applies. It's possible for them to feel that they have enough money to last a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

As such, everyone needs to consider their own personal circumstances when deciding whether to use a wealth manager or not.

Where can you start your search to find a wealth management company?

The following criteria should be considered when looking for a wealth manager service.

-

Proven track record

-

Locally based

-

Offers free initial consultations

-

Continued support

-

A clear fee structure

-

A good reputation

-

It's simple to get in touch

-

Support available 24/7

-

Offers a range of products

-

Low fees

-

No hidden fees

-

Doesn't require large upfront deposits

-

You should have a clear plan to manage your finances

-

You have a transparent approach when managing your money

-

Makes it easy for you to ask questions

-

Has a strong understanding of your current situation

-

Learn about your goals and targets

-

Are you open to working with you frequently?

-

Works within your financial budget

-

Have a solid understanding of the local marketplace

-

Is willing to provide advice on how to make changes to your portfolio

-

Is available to assist you in setting realistic expectations

How does wealth management work?

Wealth Management allows you to work with a professional to help you set goals, allocate resources and track progress towards reaching them.

Wealth managers not only help you achieve your goals but also help plan for the future to avoid being caught off guard by unexpected events.

These can help you avoid costly mistakes.

How much do I have to pay for Retirement Planning

No. No. We offer free consultations so we can show your what's possible. Then you can decide if our services are for you.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

External Links

How To

How to save money on your salary

It takes hard work to save money on your salary. If you want to save money from your salary, then you must follow these steps :

-

Start working earlier.

-

You should try to reduce unnecessary expenses.

-

Online shopping sites like Flipkart or Amazon are recommended.

-

Do your homework in the evening.

-

Take care of yourself.

-

It is important to try to increase your income.

-

Living a frugal life is a good idea.

-

You should always learn something new.

-

You should share your knowledge.

-

Books should be read regularly.

-

Make friends with rich people.

-

It's important to save money every month.

-

It is important to save money for rainy-days.

-

Your future should be planned.

-

It is important not to waste your time.

-

Positive thoughts are best.

-

Negative thoughts should be avoided.

-

Prioritize God and Religion.

-

Good relationships are essential for maintaining good relations with people.

-

You should enjoy your hobbies.

-

It is important to be self-reliant.

-

Spend less than what your earn.

-

It is important to keep busy.

-

Be patient.

-

You should always remember that there will come a day when everything will stop. It's better if you are prepared.

-

You shouldn't ever borrow money from banks.

-

Always try to solve problems before they happen.

-

You should strive to learn more.

-

It is important to manage your finances well.

-

You should be honest with everyone.