One of the key differences between robo-advisors and financial advisers is their fee structure. An average robo adviser charges 0.02 to 1% annually for an investment portfolio. This fee is often less than that of traditional financial advisers. Robo advisors can be transparent about their fees. Additionally, they are legally obligated to act in the client's best interest. While a robo advisor is not for every person, many people find them useful. They are usually less expensive than hiring a traditional financial advisor, and those who are comfortable using technology can find them a better match.

robo advisors charge annual fees ranging from 0.02 percent to 1 percent of investment portfolios

When evaluating a robo advisor, consider how much it will cost you per year. A lot of these services charge an annual cost of between 0.02 and 1.0 percent from the total value the investment portfolio. Some of these robo-advisors charge more, and some charge much less. You can compare the fees structure of a robot-advisor with the one for an actively managed fund to see the difference in cost.

Most robo-advisors charge an annual fee, but some providers offer free services. SoFi Automated Investing, for example, offers free services. Other providers charge a 0.25 per cent annual fee.

robo advisors lack personal human contact

The relationship with your financial advisor is one of its greatest advantages. Robo-advisors, while providing a digital interface for clients, typically lack the personal human connection that makes financial planning so valuable. Investors can avoid making emotionally charged investment decisions by building a long-lasting relationship with a professional financial advisor.

There is another important difference between robo and human financial advisors. The fees charged by human financial advisors range from 1% to 2.5% of the client's assets, while robo advisers can charge as high as 0.1% to 0.5%. Robotic advisors are good for investors with small portfolios, but not for those who require a human to assist them in investing.

robo advisors can't handle complex portfolios

Robo-advisors use algorithms in order to manage investment portfolios. Modern Portfolio Theory (MPT) is a method that diversifies to maximize returns and minimize risk. It is similar in concept to the "don’t place all your eggs in one pan" philosophy. It helps to keep your investment portfolio on the upward trend, even in volatile markets.

Robo advisors are usually designed to manage portfolios of stocks or bonds. However, index mutual funds are also used by some. These funds are a collection of bonds and stocks that can be traded every day. These investments are often lower-cost and tax-efficient.

Robot advisors are able to make a profit picking the best investments.

Consider the cost of using a robot-advisor to manage your investments. While most of these services are available online, others require that you speak with a person to get the best advice. Some will ask for your Social Security numbers or tax forms. To determine the best investment strategy, they may also ask questions. These questions can include your age, retirement goals, and risk tolerance. Once you have provided all the information requested, the robot advisor will manage your first deposit and any future deposits.

Robo advisors not only offer investment advice but can also help you avoid costly mistakes by automatically rebalancing and advising you. While some of these programs may not be able to pick the best investments for you, others may be more adept than you are at investing. They often offer tax-loss harvesting strategies.

FAQ

Why is it important to manage wealth?

To achieve financial freedom, the first step is to get control of your finances. Understanding your money's worth, its cost, and where it goes is the first step to financial freedom.

You should also know how much you're saving for retirement and what your emergency fund is.

If you do not follow this advice, you might end up spending all your savings for unplanned expenses such unexpected medical bills and car repair costs.

How To Choose An Investment Advisor

The process of choosing an investment advisor is similar that selecting a financial planer. You should consider two factors: fees and experience.

Experience refers to the number of years the advisor has been working in the industry.

Fees represent the cost of the service. These costs should be compared to the potential returns.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

What is retirement planning?

Retirement planning is an important part of financial planning. This helps you plan for the future and create a plan that will allow you to retire comfortably.

Retirement planning means looking at all the options that are available to you. These include saving money for retirement, investing stocks and bonds and using life insurance.

Where To Start Your Search For A Wealth Management Service

You should look for a service that can manage wealth.

-

Can demonstrate a track record of success

-

Locally based

-

Offers free initial consultations

-

Supports you on an ongoing basis

-

A clear fee structure

-

Good reputation

-

It's easy to reach us

-

You can contact us 24/7

-

Offers a range of products

-

Low fees

-

Do not charge hidden fees

-

Doesn't require large upfront deposits

-

Has a clear plan for your finances

-

Has a transparent approach to managing your money

-

Allows you to easily ask questions

-

Does your current situation require a solid understanding

-

Learn about your goals and targets

-

Is willing to work with you regularly

-

Works within your financial budget

-

Have a solid understanding of the local marketplace

-

You are available to receive advice regarding how to change your portfolio

-

Is available to assist you in setting realistic expectations

What is risk management in investment administration?

Risk Management refers to managing risks by assessing potential losses and taking appropriate measures to minimize those losses. It involves the identification, measurement, monitoring, and control of risks.

A key part of any investment strategy is risk mitigation. The purpose of risk management, is to minimize loss and maximize return.

These are the core elements of risk management

-

Identifying the sources of risk

-

Measuring and monitoring the risk

-

Controlling the risk

-

Managing the risk

Statistics

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

External Links

How To

How do you become a Wealth Advisor

Wealth advisors are a good choice if you're looking to make your own career in financial services and investment. There are many opportunities for this profession today. It also requires a lot knowledge and skills. If you have these qualities, then you can get a job easily. A wealth advisor is responsible for giving advice to people who invest their money and make investment decisions based on this advice.

Before you can start working as wealth adviser, it is important to choose the right training course. The course should cover topics such as personal finance and tax law. It also need to include legal aspects of investing management. After you complete the course successfully you can apply to be a wealth consultant.

Here are some suggestions on how you can become a wealth manager:

-

First, learn what a wealth manager does.

-

Learn all about the securities market laws.

-

You should study the basics of accounting and taxes.

-

After completing your education you must pass exams and practice tests.

-

Finally, you will need to register on the official site of the state where your residence is located.

-

Apply for a licence to work.

-

Give clients a business card.

-

Start working!

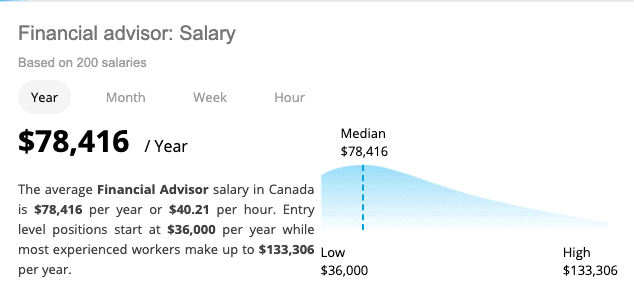

Wealth advisors typically earn between $40k and $60k per year.

The size and location of the company will affect the salary. If you want to increase income, it is important to find the best company based on your skills and experience.

Summarising, we can say wealth advisors play an essential role in our economy. It is important that everyone knows their rights. You should also be able to prevent fraud and other illegal acts.