Facet Wealth is a virtual financial planning firm that offers financial planning services to consumers through the internet. The company charges no hourly rates and offers financial planning services for a flat fee. You will need to complete a short questionnaire and a financial questionnaire in order to become a client. If you meet the criteria, the company may reach out to determine if you are eligible.

Facet Wealth is a virtual financial-planning firm

Facet Wealth is a virtual service that allows you to connect with a CFP(r). It helps you plan your future and invest the money. These services are tailored to each client's specific needs. This can include planning for major life events, tax planning and investment management. These services are offered for an annual fee starting at $1,800.

Facet Wealth is a good option for anyone who does not want to work with a traditional financial-planning firm. It offers personalized portfolios built from a list of low-cost ETFs that are designed to minimize costs and diversify investments. These products have low expense ratios and provide exposure to a wide range of asset classes. They also offer good balances between reward and risk.

It allows for online financial planning

Facet Wealth provides a great online alternative to traditional face-toface meetings if you want to work with a financial professional. They provide an online dashboard that tracks all aspects of your finances. This dashboard is accessible 24/7 to help you keep track of all aspects of your finances and to make adjustments in order to reach your goals.

Each client of Facet Wealth has a certified personal financial planner assigned to them. These professionals work with clients to design a personalized investment plan. They can also perform regular plan reviews and formal check-ins. They can be contacted any time if you have questions, and they can also modify the plan as your circumstances change.

Flat fees are charged

Facet Wealth offers clients a 360-degree, personalized view of their financial lives. During a 30-minute introductory call, they will map out your goals and discuss your current financial situation and needs. These calls are confidential and not subject to pressure. Clients can also schedule them after hours. Clients have the option to chat with their advisor over the phone or by video conference.

This service is for those with net worths between $70,000 and $1 million and who are interested to learn more about financial planning. The service offers professional advice on planning for retirement, income, tax, and education. It is also more affordable than using a robo-advisor or hiring an independent CFP.

It is a fee only firm

Facet Wealth could be the right option for you if a fee-only service is what you're seeking. This firm provides financial planning services to clients whose net worth is between $70,000-$1 million. The advisors are Certified Financial Planners, and they act as fiduciaries. This means that they only focus on the best interests of their clients.

Fee-only firms are a great option for individuals who have financial goals and don't want a conflict of interest. The fiduciary CFPs at Facet Wealth are completely independent and don't receive commissions for their services. The firm also offers the flexibility of virtual meetings, which may appeal to those with high technological skills.

It doesn't collect commissions on trades or the sale of certain products

Facet Wealth is a financial management company that manages investments for clients. It provides professional financial advice as well as portfolio management services. It also offers services like retirement planning and tax planning. The fee charged by the company is much lower than that of an independent CFP advisor or robo adviser.

Facet Wealth is an innovative type of financial planning service. Facet Wealth is unique in that it pairs clients and a certified financial professional to provide personal advice. The company's over 100 CFPs offer financial advice to traditional households. Facet was recently named the "Best Online Financial Planning Service" (NerdWallet) and one of 50 Best Places To Work in Fintech (Fintech by Financial Planning).

FAQ

How do you get started with Wealth Management

You must first decide what type of Wealth Management service is right for you. There are many Wealth Management services, but most people fall within one of these three categories.

-

Investment Advisory Services. These professionals will assist you in determining how much money you should invest and where. They also provide investment advice, including portfolio construction and asset allocation.

-

Financial Planning Services- This professional will assist you in creating a comprehensive plan that takes into consideration your goals and objectives. Based on their expertise and experience, they may recommend investments.

-

Estate Planning Services – An experienced lawyer can guide you in the best way possible to protect yourself and your loved one from potential problems that might arise after your death.

-

Ensure that a professional you hire is registered with FINRA. You don't have to be comfortable working with them.

Why it is important that you manage your wealth

Financial freedom starts with taking control of your money. You need to understand how much you have, what it costs, and where it goes.

You also need to know if you are saving enough for retirement, paying debts, and building an emergency fund.

If you don't do this, then you may end up spending all your savings on unplanned expenses such as unexpected medical bills and car repairs.

How to Beat Inflation with Savings

Inflation is the rise in prices of goods and services due to increases in demand and decreases in supply. Since the Industrial Revolution, people have been experiencing inflation. The government regulates inflation by increasing interest rates, printing new currency (inflation). There are other ways to combat inflation, but you don't have to spend your money.

For example, you can invest in foreign markets where inflation isn't nearly as big a factor. Another option is to invest in precious metals. Since their prices rise even when the dollar falls, silver and gold are "real" investments. Precious metals are also good for investors who are concerned about inflation.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

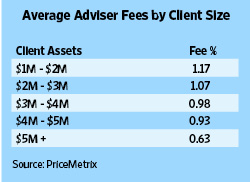

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

External Links

How To

What to do when you are retiring?

After they retire, most people have enough money that they can live comfortably. But how can they invest that money? While the most popular way to invest it is in savings accounts, there are many other options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You can also get life insurance that you can leave to your grandchildren and children.

If you want your retirement fund to last longer, you might consider investing in real estate. Property prices tend to rise over time, so if you buy a home now, you might get a good return on your investment at some point in the future. If you're worried about inflation, then you could also look into buying gold coins. They don't lose their value like other assets, so it's less likely that they will fall in value during economic uncertainty.