New Hampshire has many financial professionals. It can be difficult to pick the right one for your specific needs. There are many types. You should consider your financial goals and financial requirements before you hire a financial planner.

Benzinga recommends financial advisors in New Hampshire

New Hampshire has many financial planners. But choosing the right one is difficult. A friend or family member may suggest one, but this does not guarantee they are the right fit. It is important to understand your financial goals, budget, as well as other information in order find the right financial advisor. This will allow you to choose the best New Hampshire financial adviser for you.

There are many different types of financial planners in the State

There are many types and levels of New Hampshire's financial advisors. It can be challenging to find the right one for you. You must first be clear about your goals, budget, and financial situation before you can find the right advisor.

There are firms and independent advisors that work with high net-worth individuals. These independent advisors earn commissions for transactions with their clients. However they are required to act in their clients’ best interest. Some firms might require that they have a minimum amount of assets in order to work with them.

Investment advisors can be either sole proprietors or representatives (IARs). They must be licensed to provide advice and registered with the New Hampshire Bureau of Securities Regulation. They must also be regulated through the SEC, FINRA and the New Hampshire Bureau of Securities Regulation. You should verify their credentials and review any disciplinary history to ensure integrity.

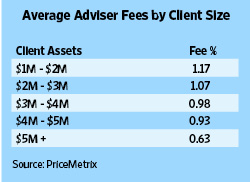

Fees charged in New Hampshire by financial advisors

Fees charged by financial advisors vary depending on the level of their experience and what services they provide. Generally, advisory fees will be higher for firms that offer more extensive financial planning services and adopt multiple technology systems. It is important to understand that just because a firm has been registered, it does not necessarily mean that they have higher levels of skill. The presence of a website online should not be taken as an endorsement for investment advisory services. Additionally, any personalized responses or investment advice provided by a firm must comply with applicable state and jurisdiction regulations.

New England financial advisors charge fees according to the assets they manage. An account with $1 million in value will pay approximately $8,000 per year. If the account's value drops below $500,000, the fee can drop to $5,000.

FAQ

How can I get started in Wealth Management?

First, you must decide what kind of Wealth Management service you want. There are many Wealth Management service options available. However, most people fall into one or two of these categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They provide advice on asset allocation, portfolio creation, and other investment strategies.

-

Financial Planning Services: This professional will work closely with you to develop a comprehensive financial plan. It will take into consideration your goals, objectives and personal circumstances. Based on their professional experience and expertise, they might recommend certain investments.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

Ensure that the professional you are hiring is registered with FINRA. If you do not feel comfortable working together, find someone who does.

What are the best strategies to build wealth?

Your most important task is to create an environment in which you can succeed. You don't need to look for the money. You'll be spending your time looking for ways of making money and not creating wealth if you're not careful.

Avoiding debt is another important goal. It is tempting to borrow, but you must repay your debts as soon as possible.

You can't afford to live on less than you earn, so you are heading for failure. If you fail, there will be nothing left to save for retirement.

Before you begin saving money, ensure that you have enough money to support your family.

Who Can Help Me With My Retirement Planning?

Retirement planning can prove to be an overwhelming financial challenge for many. It's not just about saving for yourself but also ensuring you have enough money to support yourself and your family throughout your life.

It is important to remember that you can calculate how much to save based on where you are in your life.

If you're married you'll need both to factor in your savings and provide for your individual spending needs. If you're single you might want to consider how much you spend on yourself each monthly and use that number to determine how much you should save.

If you are working and wish to save now, you can set up a regular monthly pension contribution. You might also consider investing in shares or other investments which will provide long-term growth.

Contact a financial advisor to learn more or consult a wealth manager.

What Are Some Of The Benefits Of Having A Financial Planner?

Having a financial plan means you have a road map to follow. You won't have to guess what's coming next.

It provides peace of mind by knowing that there is a plan in case something unexpected happens.

Financial planning will help you to manage your debt better. Once you have a clear understanding of your debts you will know how much and what amount you can afford.

Your financial plan will help you protect your assets.

Statistics

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

External Links

How To

How to save money on your salary

It takes hard work to save money on your salary. Follow these steps to save money on your salary

-

It is important to start working sooner.

-

You should reduce unnecessary expenses.

-

Online shopping sites like Flipkart, Amazon, and Flipkart should be used.

-

You should complete your homework at the end of the day.

-

It is important to take care of your body.

-

Your income should be increased.

-

Live a frugal existence.

-

You should always learn something new.

-

Share your knowledge with others.

-

You should read books regularly.

-

You should make friends with rich people.

-

It's important to save money every month.

-

Save money for rainy day expenses

-

It is important to plan for the future.

-

It is important not to waste your time.

-

You must think positively.

-

Negative thoughts are best avoided.

-

Prioritize God and Religion.

-

Maintaining good relationships with others is important.

-

You should enjoy your hobbies.

-

Self-reliance is something you should strive for.

-

Spend less money than you make.

-

You need to be active.

-

You should be patient.

-

Always remember that eventually everything will end. It's better to be prepared.

-

You should never borrow money from banks.

-

Always try to solve problems before they happen.

-

It is a good idea to pursue more education.

-

You should manage your finances wisely.

-

Be honest with all people