You're not the only one who has ever wondered what a financial advisor earns. This article will cover topics such as: Average annual income for financial advisors, Earnings by commission, Hourly rate, and compensation for assistants. Your ability to provide value to your clients will ultimately determine your income. But there's more to financial advisor compensation than just hourly rates. Your reputation and brand awareness are other factors to be considered.

Financial advisors earn an average annual income

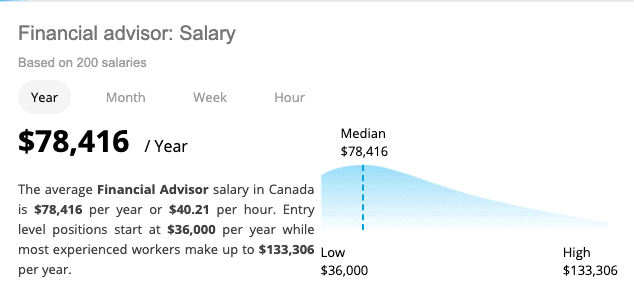

An average financial advisor makes between $69,700 and $160,000 annually. This income is mainly based on incentives. A typical financial advisor will make eighty percent of the base salary and receive ten percent as bonus payments. Lead Advisors are paid a higher percentage of their total salary, earning over $200,000 on average per year.

The compensation range for financial advisors varies depending on their level of experience and level of business development. In the top quartile, financial advisors earn between twenty and thirty percent more than the median income in the U.S. This gap is even more evident in the top quartile (service/lead).

Earnings from commissions

There are many different ways to earn money as a financial advisor. Commissions are paid to financial advisors who sell mutual funds. Others earn by selling insurance policies and annuities. Potential clients should be made aware of the income sources of commission-based advisors. Some people make up to $150 for the sale of annuities or mutual funds.

Not all commission-based advisers are dishonest. For example, some advisors promote products that pay them the highest commissions, even though these are not necessarily the best investments for their clients. It is important not to forget that not every advisor puts their clients' interests before theirs. One advisor I met was willing to pay a flat rate for a financial program, but charged clients a commission for every sale.

Hourly rate

The time that a financial advisor spends with clients will determine the hourly rate. Financial advisors spend about half their time with clients. The average advisor will spend $100 to $150 an hour on client-facing tasks. A total of 50 hours a year spent with clients can lead to a potential earning potential of $150,000 annually. Based on the financial plan's complexity and the expertise of advisors and their team, the hourly rate will vary.

A financial advisor who charges an hourly fee will answer any questions you have, provide suggestions, and help with your financial planning. An annual retainer fee is also available if you are only looking for advice for a few minutes per year.

Compensation for a financial advisor assistant

A financial advisor's assistant often assists in the preparation of a client’s retirement planning. This position requires extensive knowledge of retirement planning and communication skills. This position may also involve helping clients develop budgets or make savings decisions. An assistant to a financial advisor will need to be proficient in using a variety computer programs as well as being knowledgeable about insurance policies.

The average salary for a financial advisor assistant ranges between $36,000 and $51,000 annually. Depending on the experience and size of the company, salaries can be higher or lower than this average.

FAQ

What Are Some Of The Different Types Of Investments That Can Be Used To Build Wealth?

There are several different kinds of investments available to build wealth. Here are some examples:

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each one has its pros and cons. Stocks and bonds are easier to manage and understand. However, they tend to fluctuate in value over time and require active management. On the other hand, real estate tends to hold its value better than other assets such as gold and mutual funds.

It comes down to choosing something that is right for you. It is important to determine your risk tolerance, your income requirements, as well as your investment objectives.

Once you have chosen the asset you wish to invest, you are able to move on and speak to a financial advisor or wealth manager to find the right one.

How old should I be to start wealth management

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

The sooner you invest, the more money that you will make throughout your life.

If you are thinking of having children, it may be a good idea to start early.

You could find yourself living off savings for your whole life if it is too late in life.

How to Choose an Investment Advisor

The process of choosing an investment advisor is similar that selecting a financial planer. Consider experience and fees.

It refers the length of time the advisor has worked in the industry.

Fees refer to the cost of the service. These costs should be compared to the potential returns.

It is important to find an advisor who can understand your situation and offer a package that fits you.

What is retirement planning exactly?

Retirement planning is an important part of financial planning. It helps you prepare for the future by creating a plan that allows you to live comfortably during retirement.

Planning for retirement involves considering all options, including saving money, investing in stocks, bonds, life insurance, and tax-advantaged accounts.

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

External Links

How To

How to beat inflation with investments

Inflation will have an impact on your financial security. Inflation has been steadily rising over the last few decades. Each country's inflation rate is different. India, for example, is experiencing a higher rate of inflation than China. This means that you may have some savings, but not enough to cover your future expenses. If you don't make regular investments, you could miss out on earning more income. So how should you deal with inflation?

Stocks investing is one way of beating inflation. Stocks have a good rate of return (ROI). These funds can also be used to buy real estate, gold, and silver. However, before investing in stocks there are certain things that you need to be aware of.

First of all, choose the stock market that you want to join. Do you prefer small or large-cap businesses? Then choose accordingly. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Are you interested in growth stocks? Or value stocks? Then choose accordingly. Finally, understand the risks associated with the type of stock market you choose. There are many types of stocks available in the stock markets today. Some stocks can be risky and others more secure. Be wise.

If you are planning to invest in the stock market, make sure you take advice from experts. They will be able to tell you if you have made the right decision. Diversifying your portfolio is a must if you want to invest on the stock markets. Diversifying can increase your chances for making a good profit. If you invest only in one company, you risk losing everything.

If you still need help, then you can always consult a financial advisor. These professionals will guide you through the process of investing in stocks. They will guide you in choosing the right stock to invest. They will help you decide when to exit the stock exchange, depending on your goals.